Call Calendar Spread - Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106) Option Strategist

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a calendar call spread is an options strategy where two calls are traded on the same underlying.

Calendar Spread Options Trading Strategy In Python

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a calendar spread is an option trade that involves buying and selling an option on the.

How to Trade Options Calendar Spreads (Visuals and Examples)

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call.

Long Call Calendar Spread Explained (Options Trading Strategies For Beginners) YouTube

Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option.

Trading Guide on Calendar Call Spread AALAP

Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an option trade that involves buying and selling an option on the.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option.

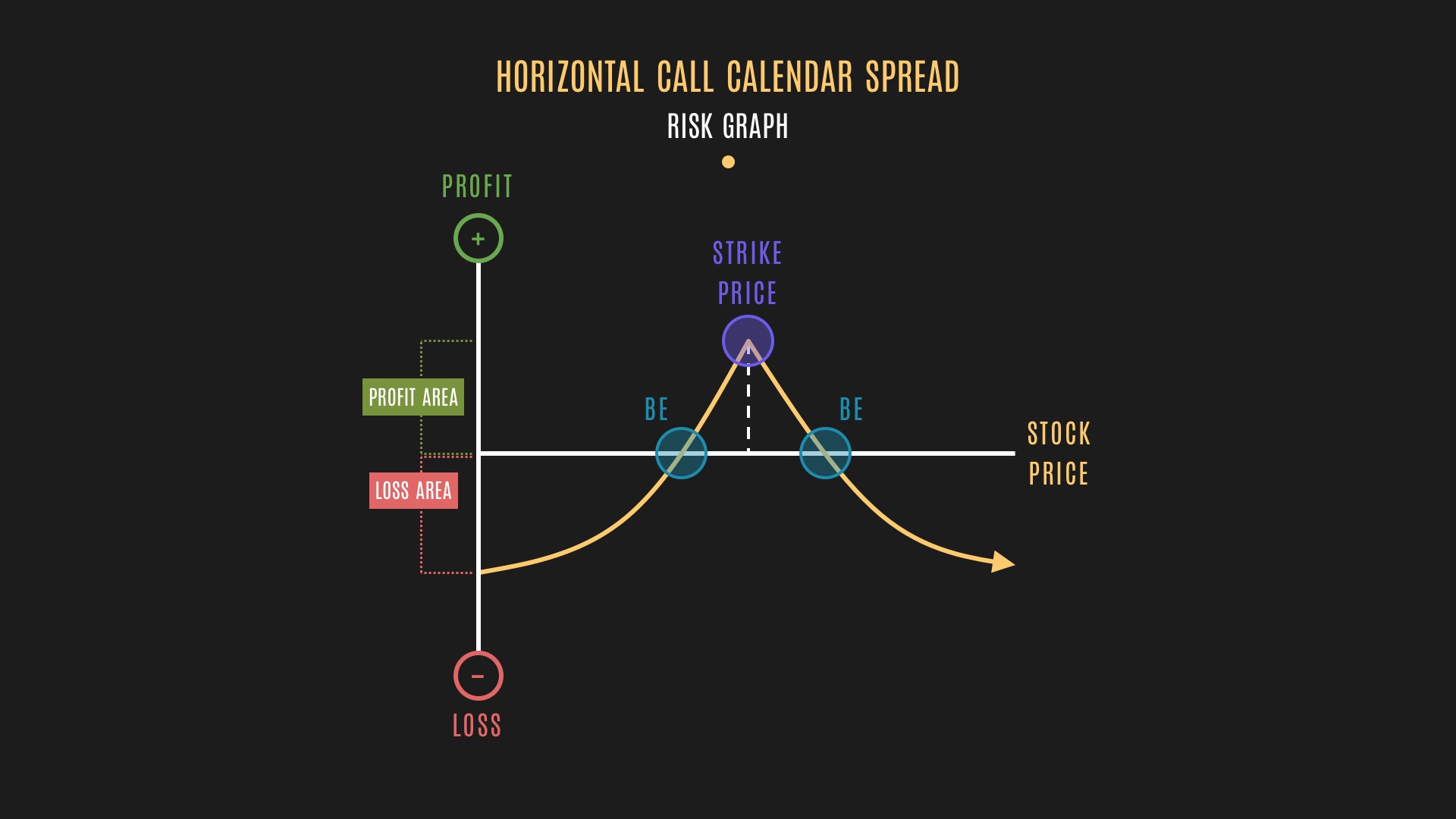

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option.

Calendar Call Spread Options Edge

Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option.

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option.

Call Calendar Spread

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long call calendar spread involves buying and selling call options for the same underlying security at the same.

Web A Calendar Call Spread Is An Options Strategy Where Two Calls Are Traded On The Same Underlying And The Same.

Web a long call calendar spread involves buying and selling call options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29a07be7965ab577d88_Call-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)